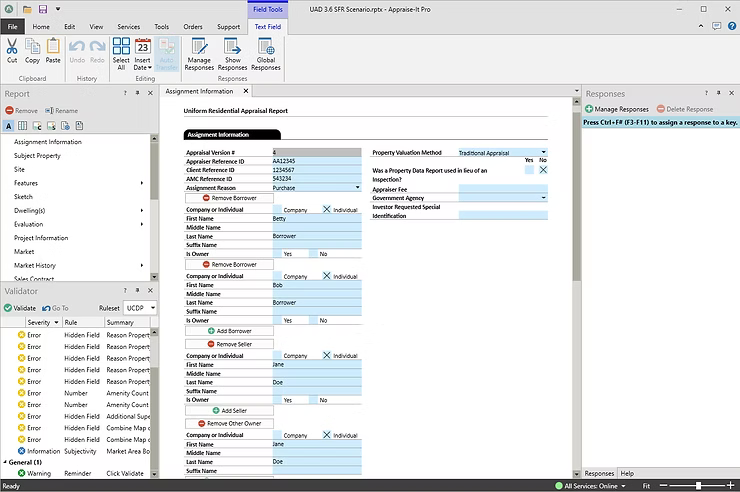

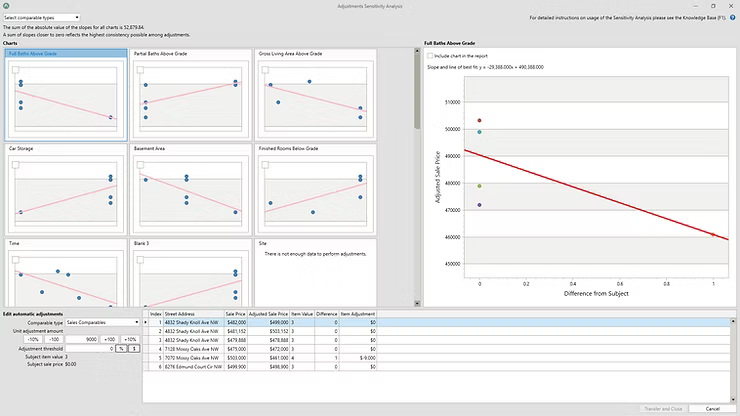

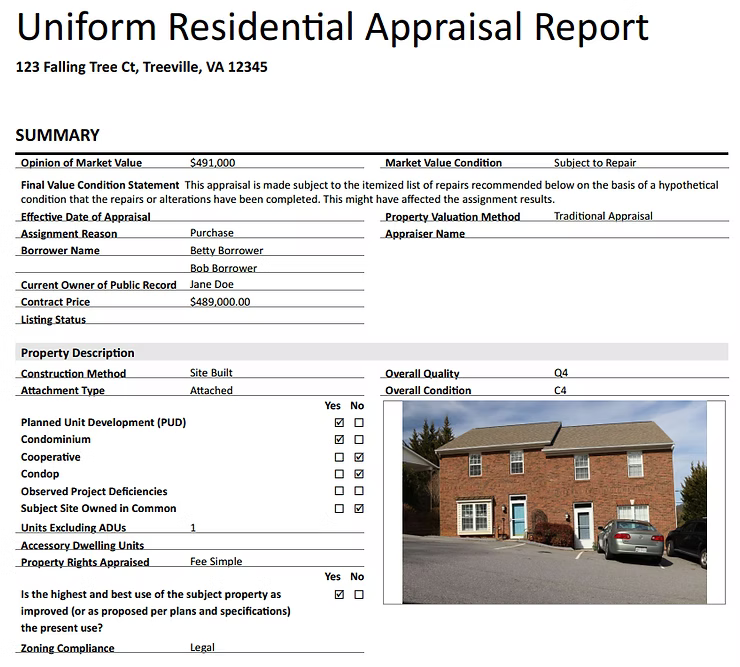

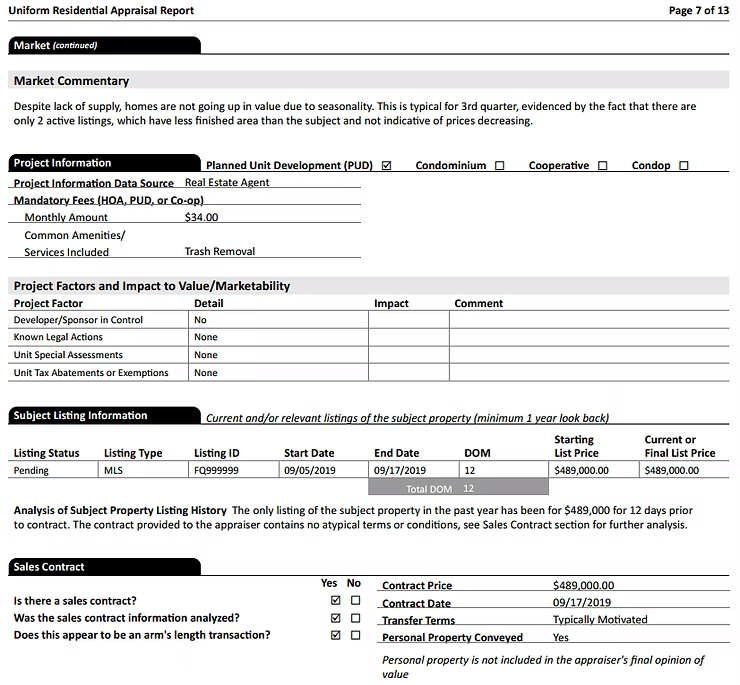

The shift to UAD 3.6 and the new dynamic Uniform Residential Appraisal Report (URAR) marks a pivotal moment in residential appraising. With its focus on structured data and granular detail, UAD 3.6 demands a heightened level of precision and detail when conducting the property inspection.

We think our new mobile inspection apps, Apex Portal and InstaPlan, will be essential tools for capturing geo-tagged photos, notes, and sketches in the field. We also understand a mobile app running on a phone or tablet may not be for everyone. And some may have the desire for a reliable, paper-based alternative.

SFREP has been listening to feedback from our users and the greater residential appraising community and we have plans to offer a number of solutions for the property inspection phase of the report writing process.

The Case for Mobile Apps

Mobile apps like Apex Portal and InstaPlan will be your best line of defense against the complexities of UAD 3.6 inspections. Here’s why you may not be able to rely on paper notes alone:

Structured Data Capture: The new URAR replaces many long narrative comments with specific, structured data fields utilizing check boxes and pull-down menus. Mobile apps are designed to collect data in this format, ensuring you don’t miss a critical element required for the final XML submission.

Real-Time Data Integrity: When you capture data on-site using your mobile phone or tablet, it’s immediately linked to the assignment, reducing the risk of data entry errors, illegible handwriting, or lost information when you return to the office.

Enhanced Media: Our apps will streamline the process of taking and organizing geo-tagged photos and your sketch, instantly associating them with the correct property. UAD 3.6 requires more detailed exhibits, and a mobile tool makes this painless.

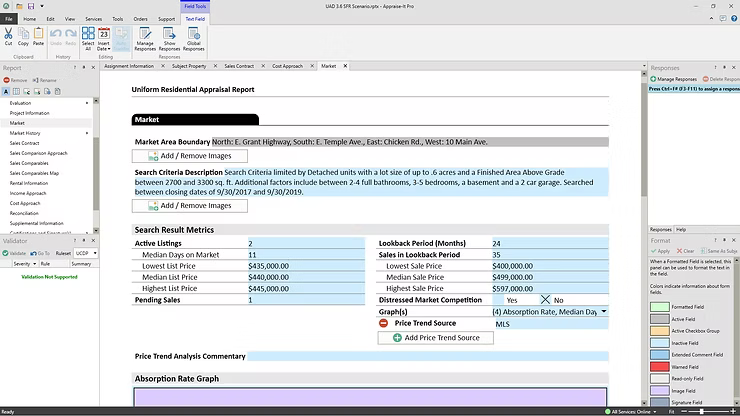

Taking the Power of Appraise-It Pro into the Field

Your fancy new laptop is light, portable and has eleven hours of battery life. Why not use it to take the full power of Appraise-It Pro into the field with you?

A new “mobile dynamic report” in Appraise-It Pro will guide you through collecting data in the field using quick and easy to use check boxes, pull-down menus and note fields. Features will include:

Guided Data Collection: When you open the Dynamic URAR in Mobile Mode on your laptop, you’ll be presented with a clean, streamlined interface optimized for field use. It leverages quick and easy checkboxes, intuitive pull-down menus, and focused note fields to capture the granular, structured data UAD 3.6 demands.

Precision and Compliance: UAD 3.6 requires detailed inputs on everything from component conditions to ADU specifics. Mobile Mode guides you through these fields sequentially, acting as a smart, digital checklist that guarantees compliance and minimizes the risk of missing critical information.

Seamless Transfer, Zero Duplication: The data you collect is stored directly within an Appraise-It Pro file on your laptop. When you get back to the office, there’s no need for transcription or data re-entry. With the simple click of a button, all your inspection inputs are instantly mapped and transferred into the proper dynamic fields of a new UAD 3.6 report, ready for analysis and finalization.

Bridging the Digital Divide: Introducing Our Printable Checklists

For some, there’s comfort and utility in a physical checklist you can hold while walking a property. To ensure every SFREP appraiser is fully prepared for the demanding data requirements of UAD 3.6 and the various new property types it covers, we are excited to announce a new tool: Printable Inspection Checklists.

We are building a library of report-type-specific checklists that you can print and attach directly to your clipboard for every inspection.

What’s Included: These aren’t generic reminders. Our checklists are designed to align directly with the expanded data fields and new reporting requirements introduced by UAD 3.6 for different property types, such as:

- Single-Family Detached

- Individual Condominium Unit

- Manufactured Homes

- Properties with Accessory Dwelling Units (ADUs)

A “Must-Have” List: They will guide you through all the necessary new details, such as the distinction between Interior Condition/Quality and Exterior Condition/Quality ratings, specific treatment of ADUs, and detailed required notes on kitchen and bath updates.

If you prefer the quick, tangible action of a checkmark or handwritten note, these physical, printed lists act as a comprehensive data gathering roadmap. It’s the assurance that you’ll have everything you need before you leave the property, minimizing the dreaded need for a second trip.

A Seamless UAD 3.6 Transition

This new reporting environment doesn’t have to be a headache. By leveraging the speed and efficiency of a mobile app or the security and structure of a purpose-built printed checklist, you can be confident that you’re collecting all the necessary information for a compliant, data-rich UAD 3.6 report.

Keep an eye on this SFREP Spotlight Blog or your email inbox for the release announcement of these new printable checklists, which will be available soon to help you prepare for the UAD 3.6 Broad Production phase!